Mês: outubro 2015

A desigualdade de renda se manteve estável no Brasil? Ou sobre a acurácia das variáveis econômicas IV

Paper do Pedro Souza e Marcelo Medeiros e apresentação do Marcelo Medeiros na UERJ:

Rodeo: um “RStudio” para Python!

Inferência causal e Big Data: Sackler Big Data Colloquium

Uma série de palestras interessantes do Sackler Big Data Colloquium:

Hal Varian: Causal Inference, Econometrics, and Big Data

***

Leo Bottou: Causal Reasoning and Learning Systems

***

David Madigan: Honest Inference From Observational Database Studies

***

Susan Athey: Estimating Heterogeneous Treatment Effects Using Machine Learning in Observational Studies

Economista e estatístico numa empresa de vídeo-games

Pense fora da caixa. Que tal trabalhar numa empresa de vídeo-games, como a Valve?

Pode ser como economista:

Economist

Valve’s multi-player games, as well as Steam (Valve’s successful trading platform), have allowed for the spontaneous emergence of complex virtual, yet quite real, economies. These economies are replete with rich trading patterns, fascinating ‘institutions’ (which have also sprung up organically), socio-economic conventions, and, generally, a host of economic phenomena that partly reflect what we observe in the analogue world and partly constitute new and unexplored behavioural patterns.

The task of a Valve economist is to make good use of the incredible wealth of data concerning these social economies, to pose fresh questions about their workings, and to generate methods for converting new knowledge about these economic vistas into tangible ideas that help improve our customers’ experiences.

Duties:

- Research, design, develop, and validate economic models to explain user behavior for all of Valve’s products.

- Design experiments to validate experimental hypotheses for in-game economies.

- Provide insight into short- and long-term behavioral patterns of participants in virtual economies.

- Inform decision-making at Valve by providing quantitative and economic rationale for various lines of inquiry.

- Create new avenues of analysis based on existing economic metrics, as well as generating new domains of data to collect and investigate.

- Collaborate with our business development team to improve the performance of existing pricing strategies and incentives for our customers and partners.

Requirements:

- Graduate degree in Economics or related field

- Advanced knowledge of statistics

- Four years experience with:

- Econometrics/data-mining or related field

- Relevant analysis techniques that inform the creation of economic models

Recommended:

- Proficiency in one or more of the following programming languages: C++, SQL, PHP, or equivalent

Ou como estatístico:

Statistician

One thing we have a lot of at Valve is data. Lots and lots of data. And we love using all that information to make better decisions. To help us do that, we’re looking for an experienced statistician who can perform quantitative analyses on all aspects of Valve’s gameplay, financial, and company data. Intrigued? You’d get to use your extensive statistical knowledge, along with practiced data-mining skills, to derive insights from the immense volumes of data we collect. In addition, you’d improve Valve’s existing metrics collection and analysis techniques by formulating new lines of inquiry into untracked metrics and creating best practices for the analysis of all collected data.

Duties:

- Research, design, develop, and validate statistical models to explain past behavior and to predict future behavior across all Valve products.

- Uncover latent trends in user behavior by mining existing statistical databases.

- Generate new lines of inquiry by creating novel metrics to incorporate into our existing tracking databases.

- Inform decision-making at Valve by providing quantitative rationale for various decision alternatives.

- Empirically evaluate financial projections and game design hypotheses.

Requirements:

- Graduate degree in Statistics or Applied Mathematics (or equivalent) field

- Extensive proficiency with one or more of the following pieces of data analysis software: SPSS, Systat, Matlab, R, or equivalent

- Four years experience with:

- Statistics/data modeling in an applied context

- Relevant statistical techniques to inform the creation of predictive models

Recommended:

- Proficiency in one or more of the following programming languages: C++, SQL, PHP (or equivalent)

Impactos de Contágio do Setor Real no Sistema Financeiro

O novo Relatório de Estabilidade Financeira (REF) do Banco Central do Brasil foi publicado ontem. Dentre várias informações interessantes, neste relatório foi publicado um boxe que discute a mensuração de impactos de contágio do setor real da economia no sistema financeiro.

Resumidamente, a partir de uma rede de conexões do setor real, o BCB simula um processo de contágio e verifica os possíveis afetados bem como seus empregados. Com esses dados em mão, o BCB mapeia as exposições do SFN a essas empresas e funcionários e, em seguida, simula um segundo processo de contágio no setor financeiro.

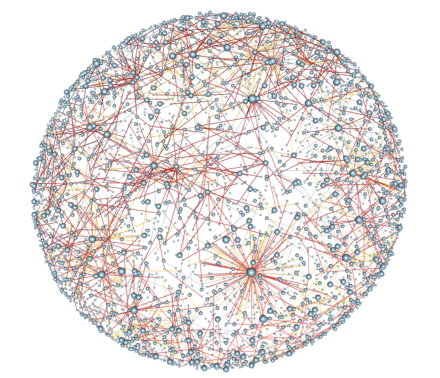

A rede do setor real (representada abaixo) foi montada a partir dos dados de TED entre as empresas. Na figura abaixo, “cada esfera representa um grupo econômico. O tamanho delas é proporcional à sua participação no fluxo de transferências do SPB. As cores das arestas refletem a importância do fluxo de TED para a empresa recebedora – quanto mais vermelho, maior a importância e maiores as chances de contágio. Nem todos os grupos estão representados.” (BCB, 2015)

Já a rede do setor financeiro é montada a partir das exposições que os conglomerados financeiros possuem entre si. Na figura abaixo, “as esferas azuis referem-se aos Bancos Múltiplos e Comerciais, as verdes, aos Bancos de Desenvolvimento, as vermelhas, aos Bancos de Investimento, as laranjas, às Cooperativas de Crédito e Financeiras, e as amarelas, às Corretoras e empresas de leasing.” (BCB, 2015)